One of RSCM’s advisors once told us, “I would think most smart people get RSCM’s philosophy intellectually, but many are stuck in the mindset that they have a particular talent to pick winners.” Another friend quipped, “VC seems to be a game of getting a reputation as a professional die thrower.”

Both of these statements resonate. But here’s the kicker: Even if you do believe in someone’s exceptional skill at rolling the dice, you may still be better off backing an unskilled roller. Diversification is that powerful.

The Dice Game: A Thought Experiment

Consider the following two investment options:

- A diversified, systematic approach – You invest $1M today, and in four years, you receive somewhere between $3M and $3.67M with 99.99% certainty.

- A concentrated bet on a “skilled” investor – You invest $1M today, and a professional rolls a six-sided die. If it lands on a 6, you get $20M in four years. But this investor is so skilled that they never roll a 1 or 2, effectively raising their chances of rolling a 6 to 25%.

Option 2 has an expected value of $5M, while Option 1 has an expected value of $3.33M. Mathematically, the professional has a 50% edge. But the problem? They still have a 75% chance of losing all your money.

If half their net worth were on the line, even the wealthiest investors would likely choose Option 1. Why? Because diversification smooths out uncertainty, even when a skilled player is involved.

The Power of Diversification in Practice

Let’s extend the dice analogy to illustrate how diversification changes the game. Suppose we analyze three types of rollers:

- Unskilled Roller: Rolls a 6 one out of six times (16.7%)

- Somewhat Skilled Roller: Avoids rolling a 1, rolling a 6 one out of five times (20%)

- Very Skilled Roller: Avoids rolling a 1 or 2, rolling a 6 one out of four times (25%)

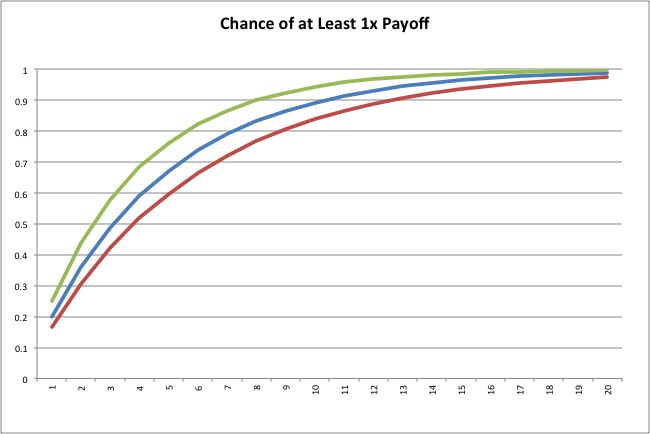

Probability of Getting Your Money Back

- At a 90% confidence level, the unskilled roller needs 13 rolls to achieve a strong chance of breaking even.

- The somewhat skilled roller needs 11 rolls.

- The very skilled roller needs 8 rolls.

A skilled roller “saves” a few rolls, but even at a 97% confidence level, an unskilled roller making 20 rolls is vastly preferable to a skilled roller making just 2 rolls, despite the latter’s higher expected value per roll.

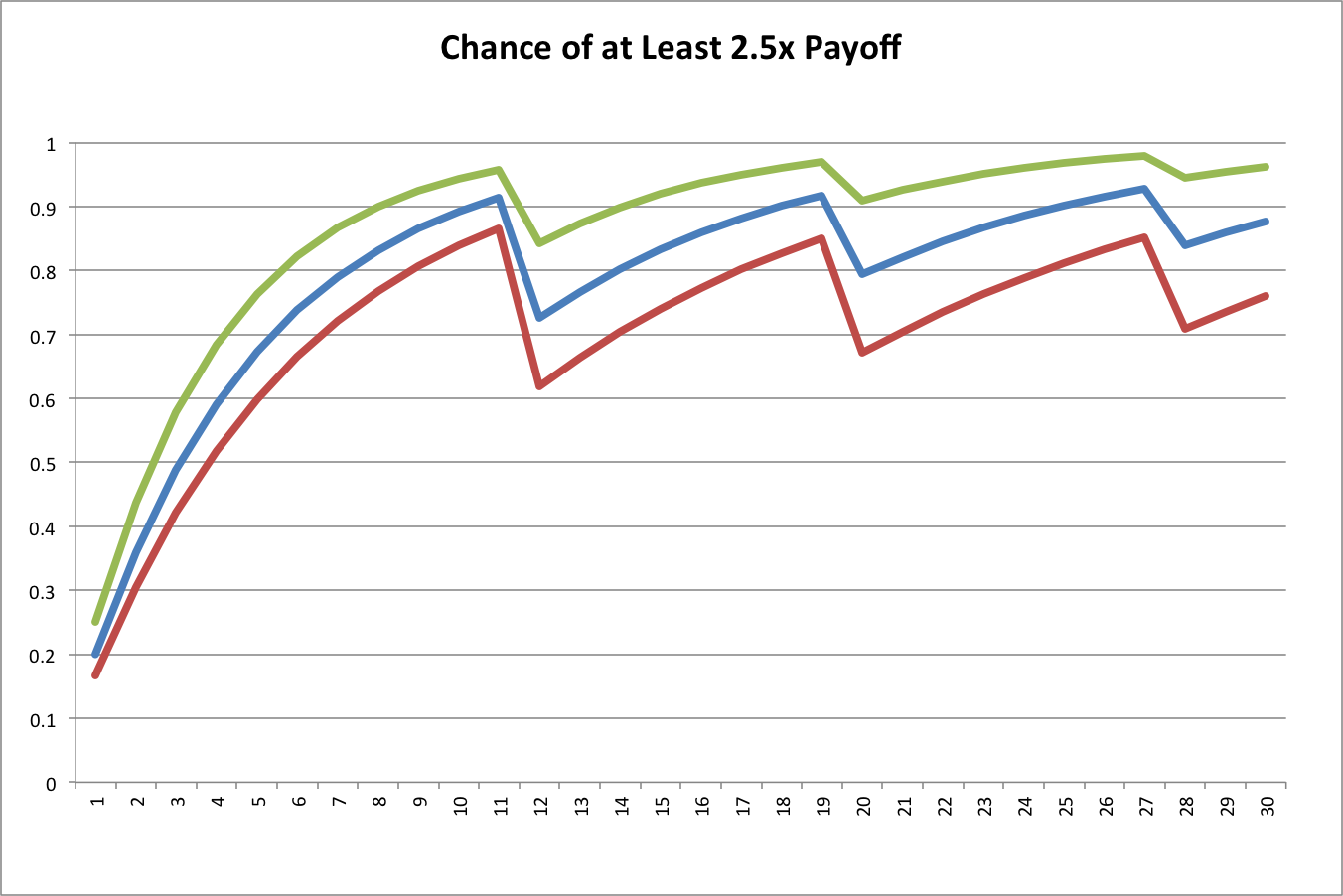

Probability of Achieving a 2.5x Return

- The somewhat skilled roller needs 2 to 5 fewer rolls than the unskilled roller to reach an 80% confidence level.

- The very skilled roller eventually dominates, but only after 30+ rolls.

- Even at 30 rolls, many investors would still prefer the 76% chance of achieving a 2.5x return from an unskilled roller over the 58% chance from a very skilled roller making just 3 rolls.

How This Applies to Startup Investing

- Number of Investments – Research from Rob Wiltbank (AIPP data) found that the average angel investor holds 8-9 investments. That’s not nearly enough for true diversification. Our dice model suggests that 100+ investments are needed for reasonable confidence levels in startup returns.

- Win Probability – In seed-stage, capital-efficient tech startups, the top 5% of outcomes account for 57% of total returns. This suggests that diversification is even more important than our dice model predicts.

- Degree of Skill – While some angels might have an edge, it’s likely modest (maybe 20% at best). Seed investing is not an environment where expertise reliably translates into outperformance—just read chapters 21 and 22 of Thinking, Fast and Slow by Daniel Kahneman.

The Takeaway

Even if you believe you (or someone you know) has skill in picking early-stage investments, diversification should come first. Then, focus on scaling the application of skill within a broad portfolio.

And remember, just because someone has a few successful investments doesn’t mean they have the magic touch. With 422,350 active angels in the U.S., even if every angel made 10 investments, pure luck would generate thousands of investors with seemingly remarkable hit rates—while tens of thousands would have zero wins, also purely by chance.

Diversification isn’t just a hedge. It’s a strategy. And in seed-stage investing, it might be the most important one you have.

This blog post was originally published 05/12/2012 and it was last updated 12/20/2024.